The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. Another common example of a fixed cost is the rent paid for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold.

Total Cost

Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). The following are the disadvantages of the contribution margin analysis. Thus, to arrive at the net sales of your business, you need to use the following formula. One packet of whole wheat bread requires $2 worth of raw material. The electricity expenses of using ovens for baking a packet of bread turns out to be $1. If the contribution margin is too low, the current price point may need to be reconsidered.

To Ensure One Vote Per Person, Please Include the Following Info

- The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products.

- Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio.

- Remember, that the contribution margin remains unchanged on a per-unit basis.

- This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas.

And to understand each of the steps, let’s consider the above-mentioned Dobson example. This means Dobson books company would either have to reduce its fixed expenses by $30,000. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances.

Products

Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution margin. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs.

How is contribution margin calculated?

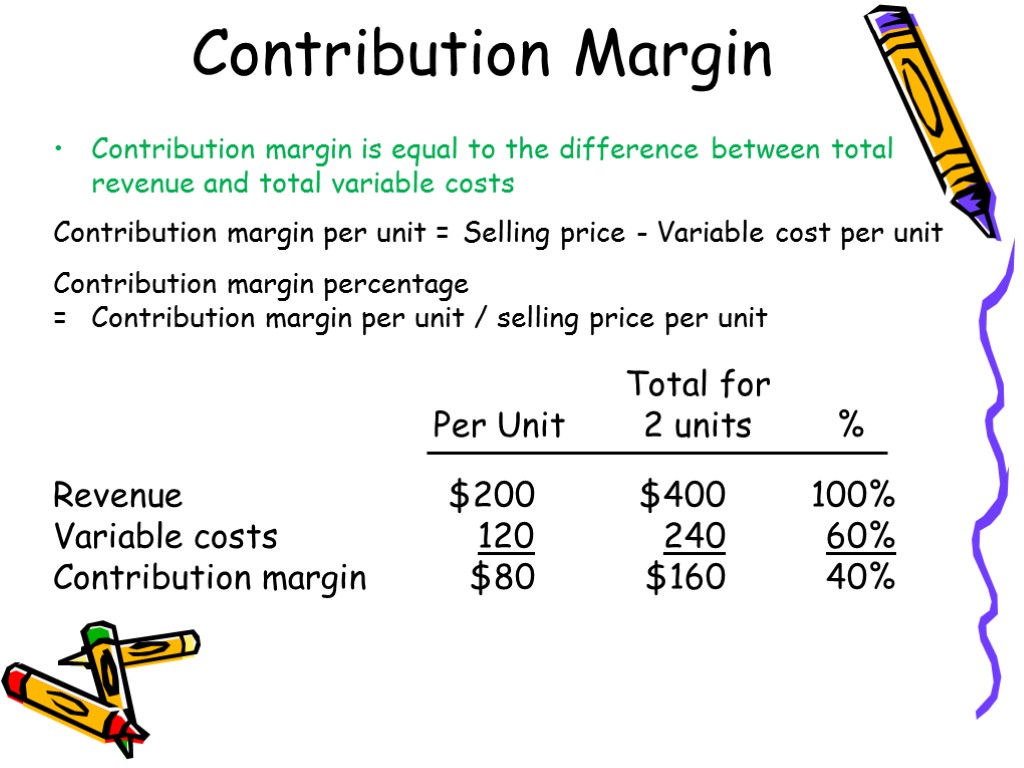

A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. In accounting, contribution margin is the difference between the revenue and the variable costs of a product.

However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. Here, we are calculating the contribution margin on order of operations for starting a startup a per-unit basis, but the same values would be obtained if we had used the total figures instead. We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step. The 60% CM ratio implies the contribution margin for each dollar of revenue generated is $0.60.

The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis.

For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans.

Leave a Reply