Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts.

You’re our first priority.Every time.

The average small business shouldn’t have to exceed this limit if its accounts are set up efficiently. The Spanish generally accepted accounting principles chart of accounts layout is used in Spain. The charts of accounts can be picked from a standard chart of accounts, like the BAS in Sweden. In some countries, charts of accounts are defined by the accountant from a standard general layouts or as regulated by law. However, in most countries it is entirely up to each accountant to design the chart of accounts. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Thirteen Steps to Set Up Your COA

In this case, it identifies the exact type of Fixed Asset being referenced. Incorporating the Maker Checker Workflow adds an additional layer of accuracy and control by implementing a dual-approval process for all entries and adjustments made to the COA. This method significantly mitigates the risk of errors and fraud, reinforcing the reliability of the financial data.

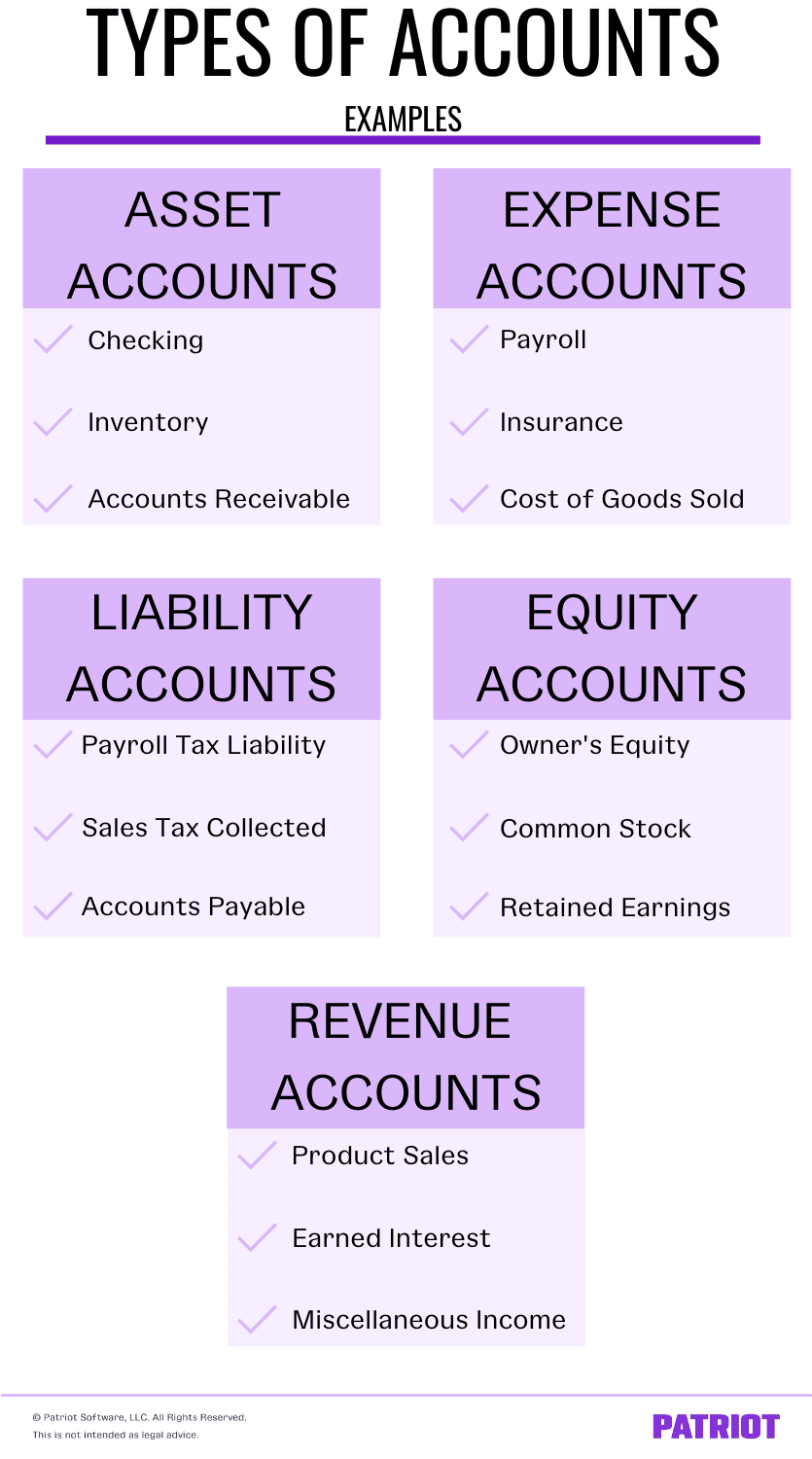

A Summary of Financial Statements

Those could then be broken down further into, e.g., current assets ( ) and current liabilities ( ). The number of figures used depends on the size and complexity of a company and its transactions. Shareholder equity (SE) is the owner’s claim after subtracting total liabilities from total assets; it represents the net worth of the business. It articulates how much owners have invested, and on the balance sheet is divided by common shares, preferred shares, and retained earnings. Usually the final line (aka the “bottom line”) of any income statement, Net Income is comprised by subtracting all business expenses and operating costs from total revenue.

What is the approximate value of your cash savings and other investments?

- This represents a more specific drill-down of the Account Type, for a supplementary and highly detailed view of the entry across a broader category, such as Fixed Assets.

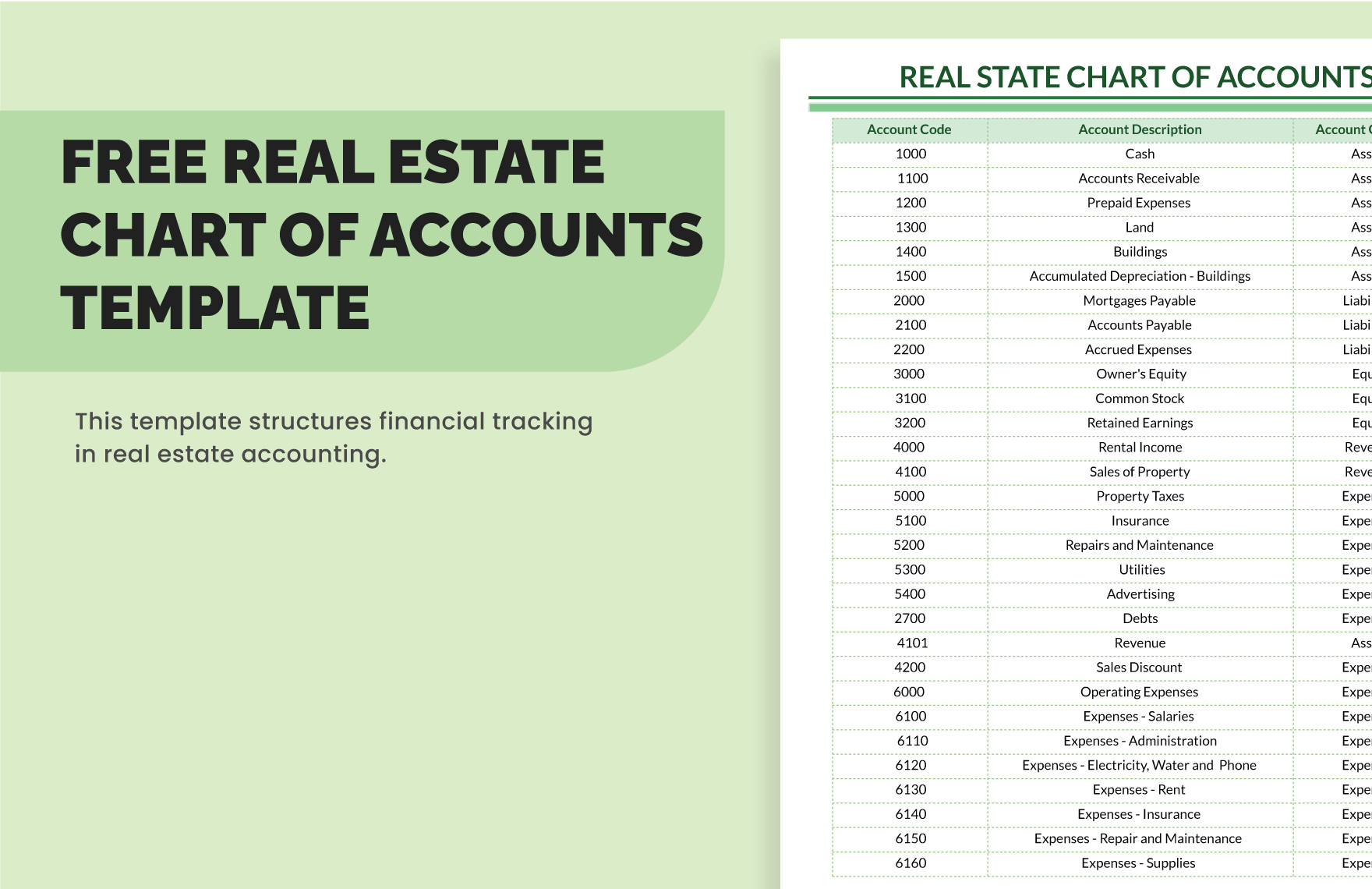

- They are grouped into categories that correspond to the structure of an organization’s financial statements.

- By the end of this blog, you’ll learn what a COA is, and how to set one up effectively.

- The chart of accounts clearly separates your earnings, expenditures, assets, and liabilities to give an accurate overview of your business’s financial performance.

- This structure aids in systematic transaction recording, financial tracking, and ensures consistent reporting across the business.

This provides an insight into all the financial transactions of the company. Here, an account is a unique record for each type of asset, liability, equity, revenue and expense. Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement.

For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts. The COA is intricately linked to an organization’s financial statements, as it provides theaggregate data necessary to create them. Each one of the accounts in your COA willshow up in your financial statements, and the COA directs where they should appear,i.e., whether they should be in the balance sheet or income statement.

Assume Big Bill’s Construction Co. purchased a work truck for $10,000 in 2005. He sells his old truck and gets a $1,500 and purchases a new truck for $25,000. xero integration guide Bookkeepers and accountants use the chart of accounts to organize and keep track of the accounts and account numbers in the accounting system.

Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging. The chart of accounts streamlines various asset accounts by organizing them into line items so that you can track multiple components easily. In addition to assisting with financial statement creation, there are other advantages to using a chart of accounts. If you don’t leave gaps in between each number, you won’t be able to add new accounts in the right order.

Each category should reflect the operations and financial activities of your business. Larger businesses might also need more detailed categories or sub-categories to accommodate diverse transactions and departments. For example, bank fees and rent expenses might be account names you use. For instance, if you rent, the money moves from your cash account to the rent expense account.

This makes it easier to find information and ensures that everyone in the business records transactions similarly. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. Yes, it is a good idea to customize your chart of accounts to suit your unique business. If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts.

Leave a Reply